Latest News & Events

Harney County Budget Committee Meeting

Harney County Courthouse 450 N Buena Vista Ave, Burns, OR, United StatesNOTICE OF HARNEY COUNTY BUDGET COMMITTEE MEETING Public meetings of the Budget Committee of Harney County, State of Oregon, to discuss the budget for the fiscal year July 1, 2024 […]

Harney County Court Meeting

Harney County Courthouse 450 N Buena Vista Ave, Burns, OR, United StatesCitizens of Harney County encouraged to participate!

Harney County Budget Committee Meeting if needed

Harney County Courthouse 450 N Buena Vista Ave, Burns, OR, United StatesNOTICE OF HARNEY COUNTY BUDGET COMMITTEE MEETING Public meetings of the Budget Committee of Harney County, State of Oregon, to discuss the budget for the fiscal year July 1, 2024 […]

Natural Resource Advisory Committee

Basement Meeting Room of the CourthouseThe Natural Resource Advisory Committee meets monthly on the first Tuesday from 6-7:30PM in the basement meeting room of the Harney County Courthouse.

Harney County Court Meeting

Harney County Courthouse 450 N Buena Vista Ave, Burns, OR, United StatesThe Harney County Court meets every 1st and 3rd Wednesday of the month starting at 9:30 AM (9:30 to 10:00 paying bills, 10 to Noon Court Session, Noon to 1PM […]

Harney County Budget Committee Meeting

Harney County Courthouse 450 N Buena Vista Ave, Burns, OR, United StatesNOTICE OF HARNEY COUNTY BUDGET COMMITTEE MEETING Public meetings of the Budget Committee of Harney County, State of Oregon, to discuss the budget for the fiscal year July 1, 2024 […]

Harney County Budget Committee

This post has information regarding the 2024-2025 Harney County Budget Committee and its meeting schedule.

Southeast Oregon Broadband Action Team

Southeast Oregon Broadband Action Team (SEOBAT) Harney County has begun the foundational work to bring reliable, affordable, high speed internet to its remote communities.

Harney County Library Advisory Board

Harney County Library Advisory Board As advocates for the library, the responsibilities of the Advisory Board are as follows:• Propose rules and policies for the governance of the library for approval to the County Court.• Prepare and submit an annual budget request...

Harney County Local Public Safety Coordinating Council

The Harney County LPSCC is a collaborative effort created as a result of Senate Bill 1145 that brings together many community partners to address local criminal justice policy and resources. Over the years, Harney LPSCC has met to address and coordinate local issues around public safety.

Harney County Local Community Health Partnership

The Harney County LCHP works to develop productive local partnerships with community-based organizations, healthcare systems (medical, behavioral, and oral health), local governments, OHP members, Tribes, and other local entities who address Social Determinants of Health and Health Equity in order to facilitate locally driven health system transformation.

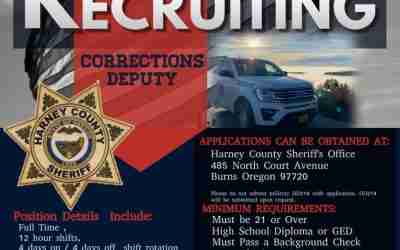

Corrections Deputy

Harney County Sheriff’s Office is currently recruiting for a Corrections Deputy. Follow the link below to learn more information.

911 Dispatch Job Opening

The Harney County Sheriff’s Office is recruiting for a 911 Dispatch position. Follow the link below for more information.

Citizen Action Center

View Current Inmates

This link accesses the list of inmates currently in custody in the Harney County Corrections facility. It is updated once per day.

Subscribe to Newsletter

Use this link to subscribe to receive Harney County Newsletter with current topics and happenings.

Employment Opportunities

Find the details about current job openings with the Harney County government.

Elected Officials

Coming Soon: Learn more about your elected officials and find contact information to engage with them.

Interactive Mapping

Explore Harney County’s GIS Map Hub using this link.

Floodplain Information

Learn more about recent updates to Harney County’s floodplain map.

Online File Center

Notices

Public notices can be found here.